Information for Employers

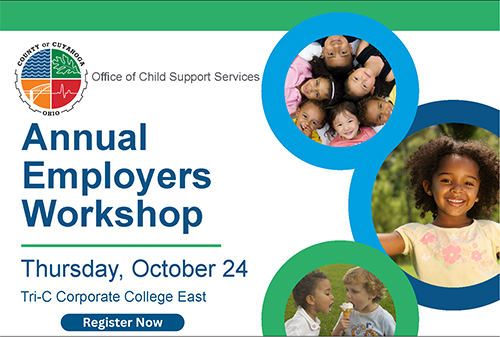

Employers Workshop

The Office of Child Support Services offers training to employers on withholding and remitting child support payments. This year, the Annual Employers Workshop will be held Thursday, October 24, 2024 at Tri-C Corporate College East. You can register now!

LEARN MORE ABOUT CHILD SUPPORT

• Processing Withholding and Medical Orders

This event is FREE with registration and there will be refreshments included. It's an ideal workshop for HR, Payroll, and Benefits professionals.

Withholding Child Support

Any order to withhold should be put into effect immediately but no later than the first pay period occurring 14 days after the date the notice was received. It is illegal to terminate an employee based on receiving an income withholding order from child

support.

Independent Contractors, Subcontractors and 1099 Employees

- Income per the Ohio Revised code is any payment in money.

- You are required to withhold from the income of the parent who is paying child support.

Multi Order Calculator

The Ohio Child Support Directors' Association offers a Multi-Order Child Support Calculator for Income Providers/Employers.

Withholding Limits

Follow the Federal Consumer Credit Protection Act (CCPA).

Do not withhold from an employee’s

disposable income more than:

- 50% of if the employee supports another dependent

- 60% if the employee does not support someone else.

An additional 5% may be garnished for support payments more than l2 weeks in arrears.

Lump Sum Payments

You are required to notify the OCSS 45 days before any lump sum payment of $150 or more is made.

Termination of Withholding

Do not terminate the withholding until you receive official notification from the OCSS to stop. Official notification is not provided by an employee.

Report Changes in Employee Status

All newly hired employees and independent contractors (with or without child support orders) who live or work in Ohio must be reported to the New Hire Reporting Center within 20 days of their start dates.

For more information, visit

Ohio's New Hire Reporting Center.

Notify the OCSS in writing within 10 days if any of the following changes occur:

- Layoff

- Termination

- Leave of absence without pay

- Payment of pension or retirement benefits

- Payment of private worker’s compensation

The notice must include the employee's last known address and any available information regarding a new employer or income source.

Federal Office of Child Support - Withholding

Employer Resource Guide

Remitting Payments

National Automated Clearing House Association (NACHA) approved ACH Credit

Please verify that your payroll software and your financial institution have the capability to remit payment via ACH credit in either the

CCD+ or CTX 820 file format. If you have questions, contact your software provider or financial institution for assistance.

Before sending the first electronic payment via ACH Credit, complete and return the Employer Registration for Electronic Funds Transfer Form.

If a company employs 50 or more employees, it is required to remit child support payments electronically.

Additional questions about electronic payments can be answered by CSPC Customer Support at 888-965-2676.

By Mail

Payments should be remitted within seven (7) days of the pay date.

Remit payments via personal check, money order, or cashier's check to:

Ohio CSPC

P.O.

Box 182394

Columbus, OH 43218-2394

- Make payable to Ohio CSPC.

- Do not send payments directly to the OCSS.

- Do not send separate checks for each employee.

- Don’t separate fees in another check.

- Use the USPS Express Mail for overnight delivery.

Information That Must be Included with Payments

Include the following with a payment to ensure prompt and accurate posting:

- Employee Name

- Employee Social Security Number (optional)

- SETS Case Number (10-digit number that begins with a 7)

- Court Order Number

- Identify each case’s portion of the check with the payment.

A remittance statement with the above information may be sent with the payment.

National Medical Support Notice (NMSN)

Your employee is ordered to provide insurance coverage (medical, dental, vision, RX, etc.) There are two parts to the NMSN - Part A and Part B.

| Part A - Return within 20 days to the OCSS | Part B - Return within 40 days to the OCSS |

| Complete if medical insurance is already being carried by the employee or the dependent(s) are enrolled in medical coverage. The employer’s responsibilities under NMSN are not affected by the child’s enrollment in Medicaid or CareSource. Please continue with enrollment of child(ren) as specified in NMSN. |

Do not terminate coverage until you receive official notice from the OCSS.

Find answers to additional employer questions on the State of Ohio’s site.

Contact Us

We're here to help. We've implemented dedicated communication resources for employers.

- Email: employerchildsupporthelp@jfs.ohio.gov

- Employer Only Telephone Line: 216-263-4548

Medical Support Requirements and Child Support 101 Panel - 2020

New Hire Reporting and Skill-Up - 2020